New Information Privacy Framework in Queensland

Queensland’s information privacy framework has been amended to better protect personal information and provide appropriate remedies for data breaches and misuse of personal information by agencies.

The cost-effective solution which makes legislative compliance easy and reduces an organisation’s regulatory burden is produced by an experienced, award-winning legal team.

Our solution significantly reduces the time which can be spent determining what laws apply to your organisation.

Our system is intuitive and deliberately designed to make compliance as simple as it can be.

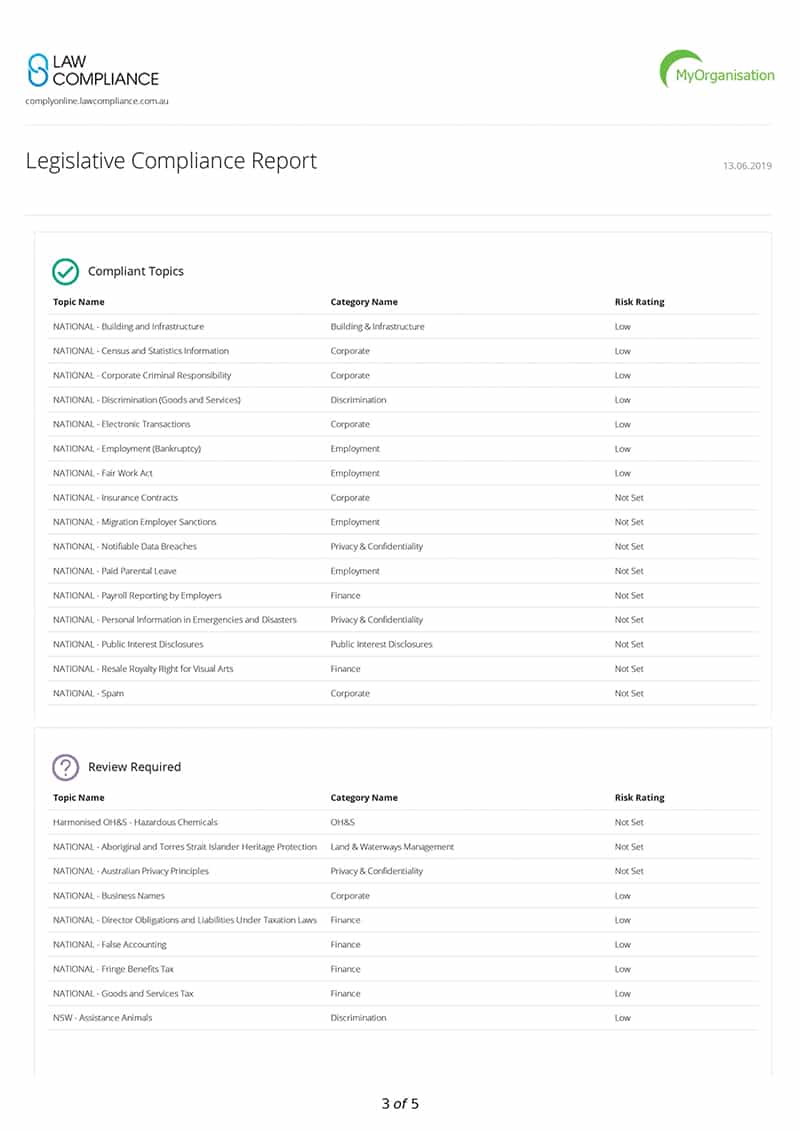

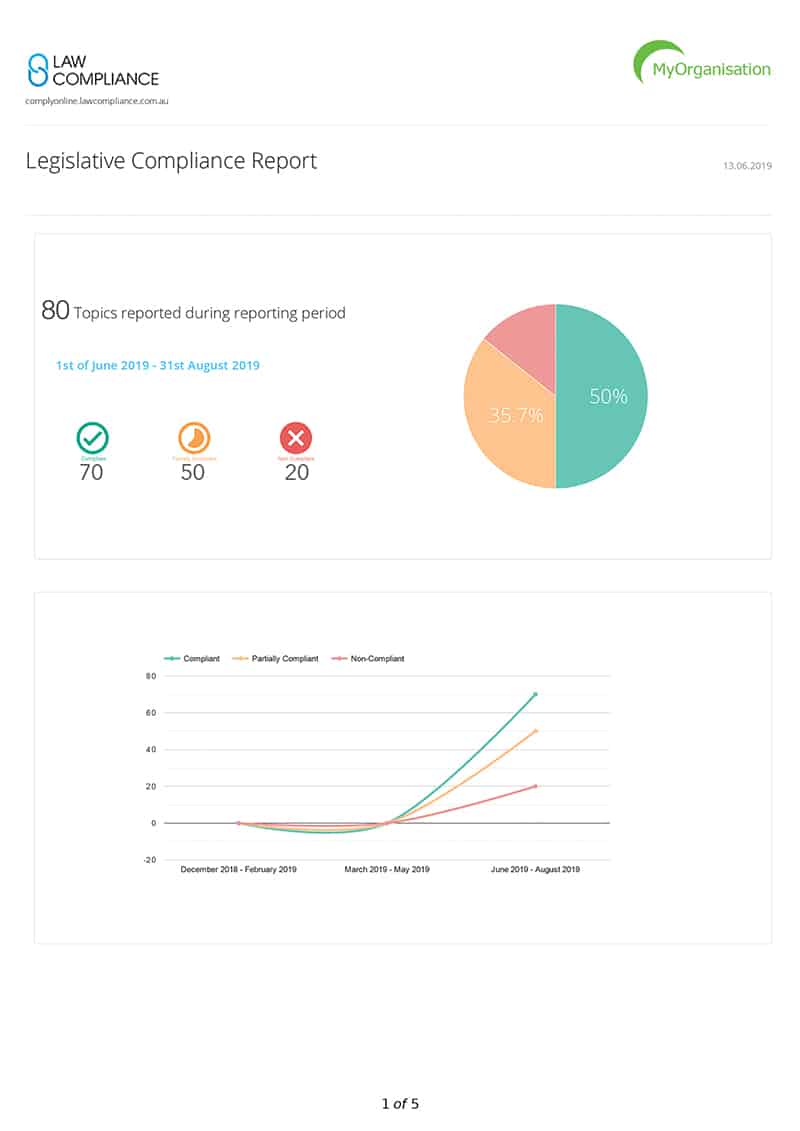

With our software option (Comply Online), risk managers, compliance managers and in-house counsel can have real time reporting of your organisation’s level of compliance.

We value each one of our clients and strive to ensure that we not only provide them with quality and support, but also listen to their feedback and grow to continuously find new ways to make legislative compliance simpler and easier.

We identify and summarise all relevant Acts and Regulations that apply to your organisation and monitor changes to those laws, so you don't need to.

Since 2008 the firm’s founder, Natalie Franks, has been annually recognised by her peers as one of Australia’s best lawyers (as published in the Australian Financial Review). In addition, Natalie was awarded “Lawyer of the Year” in 2012, 2017 and 2020, as selected by her legal peers (published by The Best Lawyers of Australia). Only a single lawyer in each practice area in each community is given this honour.

Over 300 profit and not for profit organisations across Australia and thousands of users trust and rely on our compliance products. Our clients range from small rural services to national organisations with complex reporting structures.

For more information please contact us via the details or contact form below:

Discover our latest news to help you stay on top of a wide range of compliance issues.

Queensland’s information privacy framework has been amended to better protect personal information and provide appropriate remedies for data breaches and misuse of personal information by agencies.

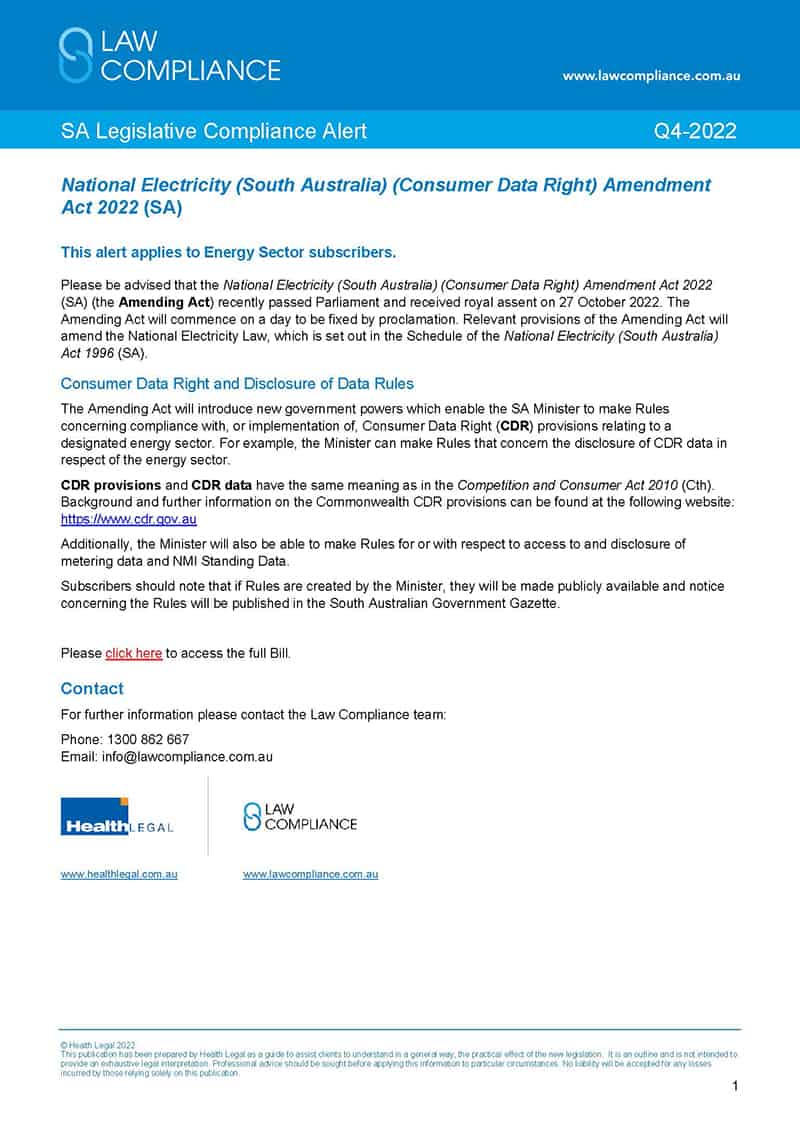

The Law Compliance Report is distributed to clients free of charge and provides insight into legislative developments in key sectors throughout Australia.

Federal Parliament introduced new legislation to require higher education providers to have a ‘support for students’ policy in place to assist students to successfully complete the units of study in which they are enrolled.

Queensland’s information privacy framework has been amended to better protect personal information and provide appropriate remedies for data breaches and misuse of personal information by agencies.

The Law Compliance Report is distributed to clients free of charge and provides insight into legislative developments in key sectors throughout Australia.

Federal Parliament introduced new legislation to require higher education providers to have a ‘support for students’ policy in place to assist students to successfully complete the units of study in which they are enrolled.

INFORMATION

QUICK LINKS